My day started out on the wrong foot. As much as I have tried over the past 15 years, to either avoid or, at least, maintain a healthy perspective about money, financial pressures have a bad habit of creeping in every now and then and setting me off on a downward spiral, emotionally. (Typical, I’ve found for not only entrepreneurs, but most professionals).

Today was one of those days. Luckily, I am fortunate enough to be in a position where that stress is (usually) short lived. First and foremost, because I have spent the time creating the mental discipline to recognize when the spiral is happening and take a step back to get perspective, but also, because I’ve been in business for myself for more than a decade and – what I hope you’ll see as the focus of this post – I have taken the time, and put in the effort, to build a financial foundation that effectively buffers both day to day and medium term financial stresses.

Going back to what started the day out poorly is an all too common story in our sector (and, I’d speculate almost any sector). For those just joining us here: AP’s parent company, ISG, puts together teams of technical experts to perform specific work for our clients – UN Agencies, IOs, NGOs, governments – which, are (usually) largely made up of independent consultants. Super typical. When we are fortunate enough to be selected to perform a piece of work, ISG contracts these consultants as subs for our prime contract for the end client.

In a perfect world, ISG’s team performs the work required, hitting whatever necessary milestones along the way to make sure that we have specific moments where our client can confirm we are on track and delivering what they expect (and, hopefully, more than they expect). These milestones also, almost always, trigger invoicing and payment events – for both us as the prime contractor and for our team members. Again, in a perfect world, we would fulfill our contractors invoices in a timely manner (30 days is the usual turn around), and the same would happen between the client and ISG.

I think you know where I’m going with this: the perfect world described above is just that. The much more common reality is that getting paid is, many times, the most painful part of being an independent professional. If I have heard it once, I’ve heard it 1000 times. In fact, not 36 hours ago, I was onsite with a partner company working on their administrative processes and, when discussing paying out consultants, the owner quickly told me, “I always pay invoices as fast as possible because I was a consultant for 20 years and I know what it’s like to be strung out on getting paid.” In the same breath, however, this partner also acknowledged that sometimes it’s just not possible because the business simply doesn’t have the cash on hand… because they too are waiting to get paid.

I believe that this is just a fundamental part of the overall game. Payments for milestone-driven contract work are chunky, by definition. This, in turn, effects available cash flow across the food chain – from client to prime to subs. This is why finding and acquiring work that allows you to invoice monthly – or some other very regular interval – is the holy grail (assuming your invoices are also fulfilled with the same consistency).

I also truly, deeply believe there is little to no malicious intent on the part of those who are slow payers. And, believe me, ISG has been (and remains) on the receiving end of that pain funnel today. If it were up to me, as soon as a consultant delivered a high quality piece of work, I’d pay them immediately. Nothing makes me happier than cutting a check for great work. It would be beyond belief to think that payments were delayed or withheld without purpose. But it does happen, for any number of reasons, and will continue to do so for the foreseeable future.

The true, unfortunate victim of this core problem is the relationships we have with one another. Otherwise super friendly and professional discourse can very quickly sour when financial strain is introduced. If it is bad enough, this can lead to reputation damage, missed opportunities and more.

The only solution that I have found to this intractable issue is to build a financial foundation that allows you to patiently wait to get paid. The bigger the better. You can choose from a huge number of options about where to hold your foundational funds, but, I’ve found only one way to actually create the foundation itself: frugality and tenacity. While, in the short run, this may put a damper on your lifestyle choices as you choose to save/invest rather than spend, in the medium to long term, the payback in terms of stress reduction, freedom and choice are, literally, invaluable.

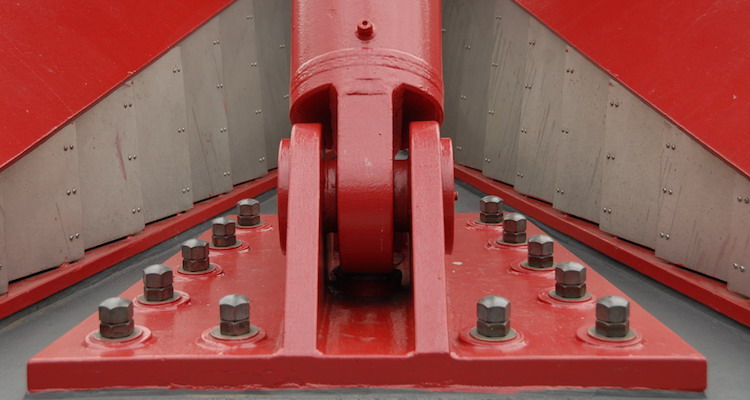

Photo by FaceMePLS and used under Creative Commons License.